As billion won to usd takes center stage, this opening passage beckons readers into a world crafted with knowledge, ensuring a reading experience that is both absorbing and distinctly original. The intricate relationship between these currencies holds sway over trade, investments, and everyday transactions, shaping the financial landscape in captivating ways.

Delving into the intricacies of exchange rates, we’ll explore the factors that influence their fluctuations and uncover the historical trends that have shaped their trajectory. By understanding the dynamics of billion won to usd, we gain a deeper appreciation of its impact on businesses, consumers, and the global economy.

Conversion Rates

The exchange rate between the South Korean won (KRW) and the US dollar (USD) is constantly fluctuating, influenced by a variety of economic and political factors. Understanding these fluctuations is crucial for businesses and individuals involved in international transactions.

Historical Fluctuations

Historically, the won-to-dollar exchange rate has experienced significant fluctuations. In the early 2000s, the won appreciated against the dollar, reaching a peak of around 950 won per dollar in 2008. However, during the 2008 financial crisis, the won depreciated sharply, reaching a low of around 1,500 won per dollar in 2009.

Since then, the won has gradually appreciated against the dollar, reaching around 1,100 won per dollar in 2023. However, the exchange rate remains volatile and subject to sudden fluctuations.

Factors Influencing the Exchange Rate, Billion won to usd

The exchange rate between the won and the dollar is influenced by several factors, including:

- Economic growth:A strong economy tends to lead to a stronger currency, as investors are more likely to invest in countries with growing economies.

- Interest rates:Higher interest rates in South Korea relative to the United States can attract foreign investment and lead to an appreciation of the won.

- Political stability:Political instability in South Korea can lead to a depreciation of the won, as investors become less confident in the country’s economic outlook.

- Global economic conditions:The global economic outlook can also impact the exchange rate, as investors seek safe haven currencies during periods of uncertainty.

Market Analysis

The exchange rate between the South Korean won (KRW) and the US dollar (USD) significantly influences trade between South Korea and the US. A stronger won makes South Korean exports more expensive for US consumers, potentially reducing demand and leading to lower exports for South Korean businesses.

Impact on Trade

The exchange rate affects the competitiveness of South Korean exports in the US market. A weaker won makes South Korean exports cheaper for US consumers, potentially increasing demand and boosting exports for South Korean businesses. Conversely, a stronger won makes South Korean exports more expensive, potentially reducing demand and leading to lower exports.

Affected Industries

Industries heavily reliant on exports to the US are particularly affected by the exchange rate. These include industries such as electronics, automobiles, and semiconductors. A stronger won can make South Korean exports less competitive in the US market, potentially leading to reduced exports and lower profits for South Korean businesses in these industries.

Implications for Businesses and Consumers

The exchange rate can impact businesses and consumers in both South Korea and the US. For South Korean businesses, a weaker won can make their exports more competitive in the US market, potentially leading to increased exports and higher profits.

However, a stronger won can make their exports less competitive, potentially leading to reduced exports and lower profits.

For US consumers, a weaker won can make South Korean products cheaper, potentially leading to increased demand and lower prices for US consumers. However, a stronger won can make South Korean products more expensive, potentially leading to reduced demand and higher prices for US consumers.

Investment Considerations

Exchange rate fluctuations can significantly impact the value of investments denominated in different currencies. Understanding these dynamics is crucial for investors seeking to mitigate risks and optimize returns.

Currency-based investments offer opportunities for diversification and potential gains, but they also come with inherent risks. Investors should carefully consider the following factors before making investment decisions.

Exchange Rate Impact on Investment Value

- When the value of the investor’s home currency appreciates against the currency of the investment, the investment’s value in the home currency will increase.

- Conversely, if the home currency depreciates, the investment’s value in the home currency will decrease.

Investment Strategies Leveraging Exchange Rate Fluctuations

- Currency Hedging:Using financial instruments to offset potential losses due to unfavorable exchange rate movements.

- Carry Trade:Borrowing in a currency with low interest rates and investing in a currency with higher interest rates, benefiting from the interest rate differential.

- Currency Arbitrage:Exploiting price discrepancies between different currency markets to generate profits.

Risks and Opportunities of Currency-Based Investments

- Exchange Rate Risk:The primary risk associated with currency-based investments is the potential for losses due to unfavorable exchange rate movements.

- Interest Rate Risk:Changes in interest rates can affect the value of currency-based investments, particularly those involving carry trades.

- Political and Economic Risk:Political and economic events in the countries whose currencies are involved can impact exchange rates and, consequently, investment values.

Historical Trends and Future Projections

The exchange rate between the billion won and the US dollar has fluctuated significantly over the years, influenced by a variety of economic and political factors. Here’s a historical timeline of some notable events that have impacted the exchange rate:

- 1997:The Asian financial crisis led to a sharp depreciation of the billion won against the US dollar.

- 2008:The global financial crisis caused another significant depreciation of the billion won.

- 2011:The Fukushima Daiichi nuclear disaster in Japan led to a strengthening of the billion won against the US dollar, as investors sought safe-haven assets.

- 2017:The election of Donald Trump as US president led to a weakening of the billion won, as investors anticipated higher interest rates in the US.

- 2020:The COVID-19 pandemic caused a sharp depreciation of the billion won, as investors sought safe-haven assets.

Over the long term, the billion won has depreciated against the US dollar. This is due to a number of factors, including South Korea’s export-oriented economy and its dependence on imports. The billion won is also affected by the US dollar’s status as the world’s reserve currency.

Looking ahead, the future direction of the billion won-US dollar exchange rate is uncertain. However, some analysts believe that the billion won may strengthen in the coming years, as South Korea’s economy continues to grow. Others believe that the billion won may weaken, as the US dollar strengthens.

Ultimately, the direction of the exchange rate will depend on a number of factors, including the economic policies of South Korea and the US, as well as global economic conditions.

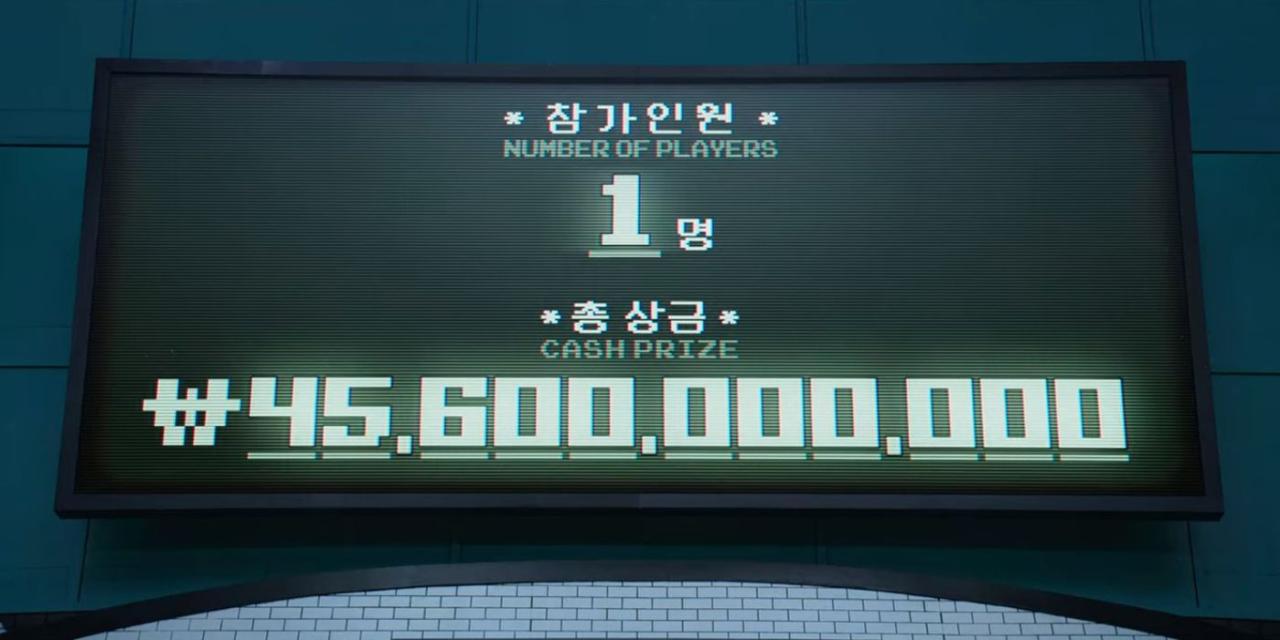

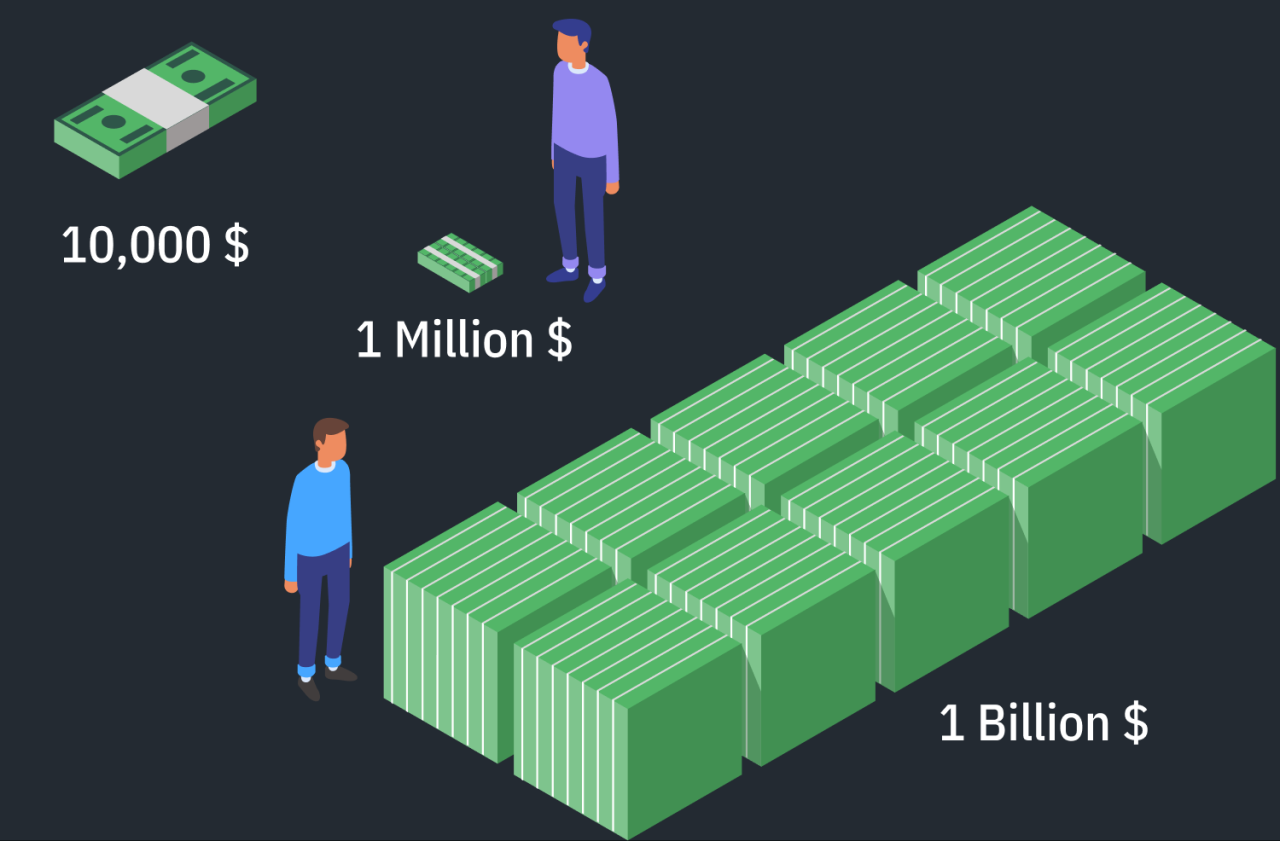

Practical Applications: Billion Won To Usd

The exchange rate between the billion won and the USD has a tangible impact on everyday transactions. Understanding how to convert billion won to USD and vice versa is crucial for individuals and businesses engaged in international trade, investments, or personal finance.

Here are some practical applications of the billion won to USD exchange rate:

Conversion Table

The following table provides the equivalent value of different amounts of billion won in USD at various exchange rates:

| Billion Won | USD (at 1,200 KRW/USD) | USD (at 1,300 KRW/USD) | USD (at 1,400 KRW/USD) |

|---|---|---|---|

| 1 | 833,333 | 769,231 | 714,286 |

| 5 | 4,166,667 | 3,846,154 | 3,571,429 |

| 10 | 8,333,333 | 7,692,308 | 7,142,857 |

| 50 | 41,666,667 | 38,461,538 | 35,714,286 |

| 100 | 83,333,333 | 76,923,077 | 71,428,571 |

This table can be used to quickly estimate the equivalent value of billion won in USD at different exchange rates.

Conversion Tool

Online conversion tools and calculators are readily available to convert billion won to USD and vice versa. These tools provide real-time exchange rates and allow users to input specific amounts for conversion.

Example:

- A business needs to convert 5 billion won to USD for an international purchase. Using a conversion tool, they can input 5 billion won and select the current exchange rate (e.g., 1,200 KRW/USD) to obtain the equivalent value in USD (approximately 4,166,667 USD).

Real-World Examples

The exchange rate between the billion won and the USD impacts everyday transactions in various ways:

- Tourism:When the USD strengthens against the billion won, it becomes more expensive for South Koreans to travel abroad. Conversely, a weaker USD makes international travel more affordable for South Koreans.

- Imports and Exports:A stronger USD makes it more expensive for South Korea to import goods from other countries. A weaker USD makes exports from South Korea more competitive in international markets.

- Investment:The exchange rate can influence investment decisions. When the USD is strong, it may be more attractive for foreign investors to invest in South Korea. Conversely, a weaker USD may make South Korean investments less attractive to foreign investors.

Understanding the exchange rate and its practical applications is essential for individuals and businesses navigating the global economy.

Wrap-Up

In conclusion, the billion won to usd exchange rate is a dynamic force that shapes the financial landscape, impacting trade, investments, and everyday transactions. Understanding the factors that influence its fluctuations and the historical trends that have shaped its trajectory empowers businesses, consumers, and policymakers to make informed decisions.

As the global economy continues to evolve, the relationship between these currencies will undoubtedly remain a topic of keen interest and analysis.

FAQ Guide

What is the current exchange rate between billion won and USD?

The current exchange rate fluctuates and can be found on currency exchange websites or platforms.

How do I convert billion won to USD?

You can use a currency converter tool or calculator to convert billion won to USD based on the current exchange rate.

What factors influence the exchange rate between billion won and USD?

Factors such as economic growth, interest rates, inflation, political stability, and global demand can influence the exchange rate.